Cermati Invest Weekly Update 12 Agustus 2024

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| IHSG | -0.70% | 7,257.00 |

| LQ45 | -1.22% | 908.13 |

| IDX30 | -0.59% | 455.86 |

| FTSE Indonesia | -0.91% | 3,518.43 |

| MSCI Indonesia | -0.52% | 7,197.22 |

| USD/IDR | -1.57% | 15,940.30 |

Provided by Cermati Invest, last update 9 Agustus 2024

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | -0.50% | 2,431.14 |

| Crude Oil WTI | 4.71% | 76.98 |

| Palm Oil c3 F | -5.44% | 3,704 |

| Natural Gas | 9.86% | 2.16 |

| Newcastle Coal | -0.07% | 144.00 |

| Nickel | 0.15% | 16,298 |

| Tin | -0.65% | 29,991 |

| Copper | -2.38% | 8,840 |

| Aluminium | 1.48% | 2,297 |

| US Soybeans | -2.97% | 987.75 |

| Silver | -3.02% | 27.54 |

Provided by Cermati Invest, last update 9 Agustus 2024

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | -0.60% | 39,497.54 |

| S&P 500 | -0.04% | 5,344.16 |

| FTSE 100 | -0.08% | 8,168.10 |

| DAX | 0.35% | 17,722.88 |

| Nikkei 225 | -2.31% | 35,081.00 |

| Hang Seng | 0.85% | 17,090.23 |

| Shanghai | -1.49% | 2,862.19 |

| KOSPI | -3.28% | 2,588.36 |

Provided by Cermati Invest, last update 9 Agustus 2024

Ulasan Pasar

IHSG & Saham Pekan Ini

IHSG, awal pekan lalu sempat terkoreksi dalam sampai ke 6998.811 (-4.23%) dalam 1 hari, seperti yang disampaikan pada market update pekan lalu, hal ini dipicu oleh buruknya data Non-Farm Payroll (NFP) dan data pengangguran Amerika, juga dipicu oleh naiknya suku bunga BOJ dan menguatnya Yen Jepang terhadap dolar Amerika. Hal ini mengindikasikan ke depannya suku bunga Amerika akan turun. Awal pekan lalu mayoritas bursa dan indeks dunia terkoreksi tajam.

Anehnya, walau IHSG terkoreksi tajam, tetapi rupiah stabil dan cenderung menguat. Hal ini mengindikasikan bahwa koreksi pada bursa hanya sementara dan akan rebound.

Pekan lalu IHSG berhasil tutup menguat ke 7256.996 atau (+) 0.86%, selain itu IHSG juga berhasil menutup support gap di 7196.754 dan resistance gap di 7264.008 sekaligus dalam 1 pekan lalu.

IHSG masih ada support gap di 6968.136, biasanya harga akan bergerak menuju gapnya, cepat atau lambat.

Big picture IHSG sejak 2022, berada di antara 6698.848 - 7454.448. Kuartal III ini, IHSG masih aman selama di atas 7105.776 (quarterly pivot).

SAHAM, pergerakan IHSG pekan lalu dipicu oleh sektor Industri, Transportasi, Energi, Cyclicals dan Perbankan.

Sedangkan performa indeks konstituen yang lebih tinggi dari IHSG, berurutan dari yang terbaik adalah Pefindo PrimeBank10, Bisnis-27, Sri-Kehati, MSCI Indonesia, IDX30, FTSE Indonesia, LQ45.

Pergerakan Rupiah

Pekan lalu rupiah menguat terhadap dolar Amerika hampir 2%, bahkan menyentuh Rp15.875 per 1 dolar Amerika. Pertengahan pekan ini Amerika akan mengumumkan data inflasi, konsesus mengatakan turun. Pekan ini rupiah stabil dalam area Rp15.714 — Rp16.183 per 1 dolar Amerika.

Emas

Awal pekan lalu emas dunia sempat terkoreksi ke 2364 US dollar, seperti bursa komoditas utama lainnya, emas kembali naik dan tutup di 2431 US dollar. Pekan ini emas dunia masih berada dalam area 2353—2507 US dollar per troy ounce.

Dalam rupiah, harga emas per gram akan berada di antara Rp1.243.728 — Rp1.261.436.

Reksa Dana & Surat Berharga

Berdasarkan data yang ada, penguatan rupiah dan kecenderungan suku bunga yang stabil, melanjutkan performa pekan lalu, pekan ini seharusnya reksa dana pendapatan tetap dan reksa dana pasar uang dapat dilirik.

Bingung cari investasi Reksa Dana yang aman dan menguntungkan? Cermati Invest solusinya!

Sempat Panik karena Isu Resesi, Pasar Investasi Kembali Membaik

Dari dalam negeri, Bank Indonesia (BI) melaporkan realisasi pertumbuhan penjualan ritel yang naik menjadi 2.7% secara tahunan pada bulan Juni 2024 dari angka periode sebelumnya di 2.1% pada bulan Mei 2024. Peningkatan tersebut sejalan dengan momentum Iduladha dan libur sekolah sehingga mendorong kenaikan permintaan. Selain itu, harga emas tetap stabil pada hari Jumat pekan lalu (9/8/2024). Meski demikian, harga emas mencatatkan penurunan secara data mingguan, harga emas secara mingguan mencatat penurunan sebesar 0.6%. Pada Senin pekan lalu (5/8/2024), harga emas sempat jatuh hingga 3% setelah investor melakukan likuidasi posisi sejalan dengan penurunan yang lebih luas di pasar saham.

Dari sisi luar negeri, Biro Statistik Nasional China menyampaikan tingkat inflasi tahunan naik menjadi 0.5% pada Juli 2024 dari yang sebelumnya di 0.2% pada Juni 2024, data tersebut melampaui perkiraan pasar sebesar 0.3%. Ini menunjukkan peningkatan berkelanjutan dalam permintaan domestik saat pemerintah China meningkatkan stimulus sebagai upaya untuk pemulihan ekonomi. Dari Amerika Serikat, Biro Ketenagakerjaan Amerika melaporkan data jumlah pengajuan baru untuk tunjangan pengangguran sepanjang pekan yang berakhir 3 Agustus 2024 berhasil turun lebih besar dari yang diharapkan. Sebagaimana kita tahu, pada awal pekan pasar keuangan global mengalami panic selling akibat peringatan resesi di Amerika yang muncul setelah data pasar tenaga kerja yang mengecewakan dari kenaikan tingkat pengangguran. Namun, dengan data klaim pengangguran yang turun setidaknya ini memberikan angin segar bagi pasar. Hal ini menunjukkan bahwa peringatan resesi mungkin terlalu berlebihan lantaran pasar tenaga kerja masih baik-baik saja.

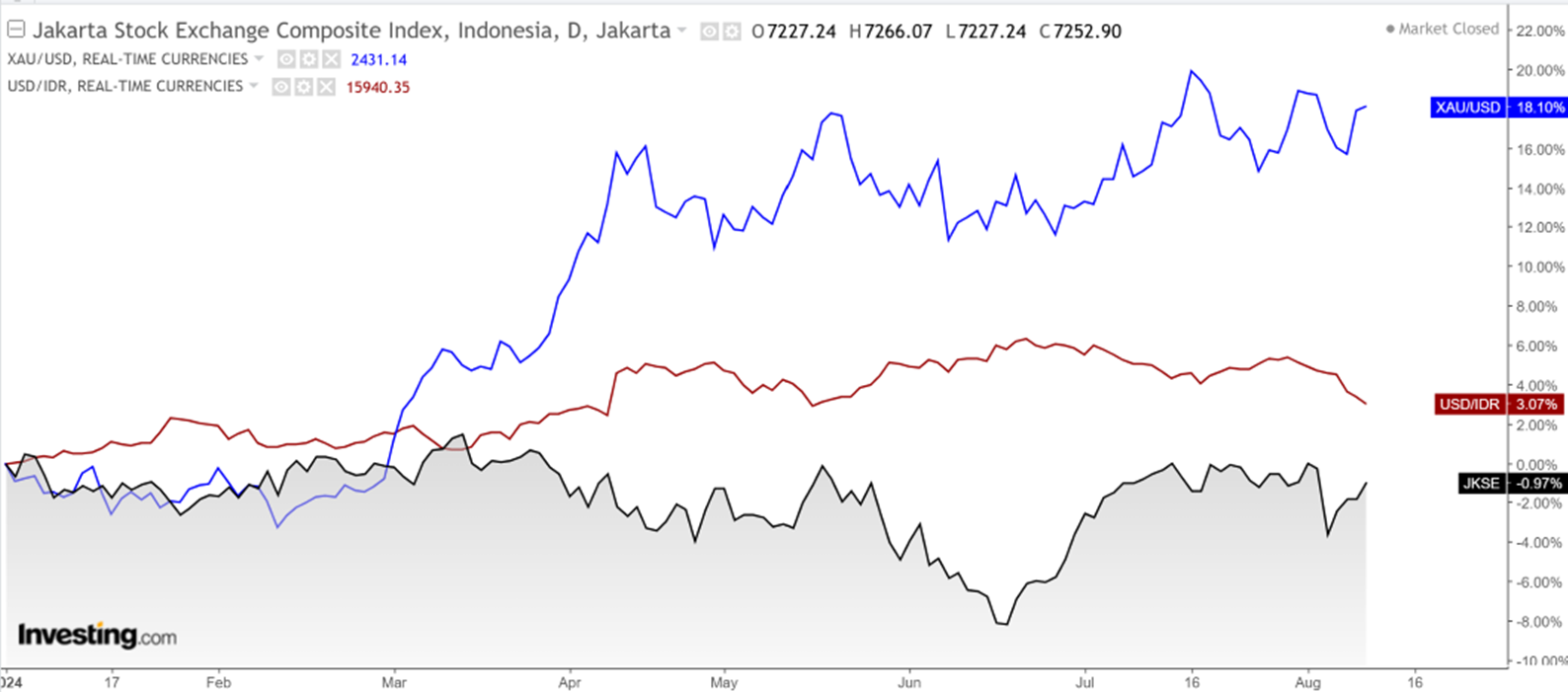

COMPOSITE INDEX compare to USDIDR & GOLD (Daily Performance) since 2024 (YtD)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Insight Retail Cash Fund | 1542.073 | 0.83% | 1.80% | 2.78% | 3.20% | 4.79% | 14.06% | 54.21% | 13 Apr 2018 | 12.33 B |

| Insight Money Syariah | 1594.411 | 0.49% | 1.54% | 2.88% | 3.42% | 5.54% | 15.73% | 59.44% | 30 Sep 2015 | 106.57 B |

| BRI Seruni Pasar Uang III | 1719.922 | 0.47% | 1.42% | 2.66% | 3.16% | 4.84% | 11.65% | 71.99% | 16 Feb 2010 | 1.35 T |

| Cipta Dana Cash | 1672.300 | 0.45% | 1.37% | 2.70% | 3.28% | 5.28% | 14.25% | 67.23% | 8 Jun 2015 | 216.24 B |

| Setiabudi Dana Pasar Uang | 1472.422 | 0.42% | 1.34% | 2.67% | 3.20% | 5.24% | 13.37% | 47.24% | 23 Dec 2016 | 783.43 B |

| TRIM Kas 2 Kelas A | 1856.989 | 0.42% | 1.32% | 2.52% | 3.00% | 4.80% | 12.96% | 85.70% | 8 Apr 2008 | 3.38 T |

| HPAM Ultima Money Market | 1576.775 | 0.41% | 1.27% | 2.49% | 2.97% | 4.78% | 13.80% | 57.68% | 10 Jun 2015 | 687.89 B |

| Trimegah Kas Syariah | 1396.651 | 0.41% | 1.31% | 2.60% | 3.13% | 4.98% | 13.00% | 39.67% | 30 Dec 2016 | 963.07 B |

| BRI Seruni Pasar Uang Syariah | 1303.749 | 0.36% | 1.31% | 2.66% | 3.24% | 5.28% | 12.34% | 30.37% | 19 Jul 2018 | 91.17 B |

Provided by Cermati Invest, last update 9 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| HPAM Government Bond | 1577.287 | 1.66% | 2.07% | 1.83% | 1.92% | 3.04% | 12.76% | 57.73% | 18 May 2016 | 19.38 B |

| Cipta Bond | 1788.140 | 1.56% | 2.07% | 1.98% | 2.07% | 3.55% | 9.24% | 78.81% | 2 Jan 2019 | 25.37 B |

| Syailendra Fixed Income Fund Kelas A | 2557.780 | 1.52% | 2.07% | 1.26% | 1.70% | 2.49% | 11.59% | 155.78% | 8 Dec 2011 | 96.16 B |

| Principal Total Return Bond Fund | 2589.330 | 1.51% | 1.99% | 1.87% | 2.01% | 1.34% | -2.96% | 158.93% | 21 Aug 2008 | 20.21 B |

| BRI Brawijaya Abadi Pendapatan Tetap | 1354.039 | 1.48% | 2.33% | 1.50% | 1.71% | 1.95% | 12.14% | 35.40% | 25 Feb 2019 | 10.85 B |

| Eastspring IDR Fixed Income Fund Kelas A | 1721.590 | 1.48% | 2.05% | 1.54% | 1.73% | 2.14% | 11.12% | 72.16% | 16 Mar 2015 | 146.30 B |

| Sequis Bond Optima | 1473.630 | 1.37% | 1.87% | 1.51% | 1.73% | 2.38% | 8.55% | 47.36% | 8 Sep 2016 | 39.86 B |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1637.920 | 1.35% | 1.28% | 0.84% | 0.95% | 1.57% | 11.96% | 63.79% | 16 Jun 2016 | 12.13 B |

| BRI Melati Pendapatan Utama | 1856.873 | 1.26% | 1.70% | 1.50% | 1.58% | 1.71% | 9.39% | 85.69% | 27 Sep 2012 | 47.70 B |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1056.110 | 1.17% | 1.26% | 0.08% | 0.76% | -0.04% | - | 5.61% | 1 Sep 2022 | 4.92 B |

| Eastspring Investments IDR High Grade Kelas A | 1662.040 | 1.16% | 1.07% | 0.96% | 1.07% | 1.61% | 9.01% | 66.20% | 9 Jan 2013 | 144.47 B |

| Danakita Obligasi Negara | 1100.630 | 1.07% | 1.96% | 1.71% | 2.14% | 3.02% | 9.14% | 10.06% | 26 Mar 2021 | 55.25 B |

| Batavia Dana Obligasi Ultima | 2893.690 | 0.75% | 0.65% | -0.31% | -0.44% | -0.85% | -1.13% | 189.37% | 20 Dec 2006 | 1.22 T |

| TRIM Dana Tetap 2 | 3130.250 | 0.71% | 1.92% | 2.78% | 3.26% | 4.87% | 14.33% | 213.03% | 13 May 2008 | 701.64 B |

| Trimegah Fixed Income Plan | 1143.509 | 0.71% | 0.84% | 0.51% | 1.00% | 0.34% | 5.21% | 14.35% | 23 May 2019 | 2.41 T |

| Eastspring Investments Yield Discovery Kelas A | 1602.850 | 0.68% | 1.03% | -0.04% | -0.25% | 0.12% | -2.29% | 60.29% | 29 May 2013 | 78.55 B |

| SAM Sukuk Syariah Sejahtera | 2427.356 | 0.65% | 0.34% | -0.13% | 0.50% | -1.93% | -0.13% | 142.74% | 29 Oct 1997 | 45.77 B |

| Insight Haji Syariah | 4894.160 | 0.54% | 1.74% | 3.29% | 3.91% | 6.10% | 22.08% | 389.42% | 13 Jan 2005 | 1.41 T |

| Insight Renewable Energy Fund | 2217.698 | 0.53% | 1.72% | 3.29% | 3.98% | 6.97% | 18.80% | 121.77% | 22 Jun 2011 | 821.21 B |

| HPAM Pendapatan Tetap Prima | 1052.406 | 0.52% | 0.42% | 0.79% | 1.45% | 1.71% | 3.21% | 5.24% | 29 Oct 2018 | 216.09 B |

Provided by Cermati Invest, last update 9 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Setiabudi Dana Campuran | 1439.974 | 1.89% | 4.72% | 6.40% | 6.37% | 5.00% | 42.75% | 44.00% | 25 Sep 2017 | 66.83 B |

| HPAM Flexi Plus | 1908.720 | 1.70% | 5.60% | 12.73% | 9.08% | 24.88% | 15.02% | 90.87% | 2 Mar 2011 | 57.25 B |

| Danakita Investasi Fleksibel | 1468.540 | 1.07% | 2.83% | 1.12% | 1.90% | 3.65% | 13.13% | 46.85% | 8 Jun 2017 | 10.27 B |

| Sequis Balance Ultima | 1246.120 | 0.69% | 2.14% | -0.19% | -0.27% | 0.99% | 16.22% | 24.61% | 8 Sep 2016 | 102.97 B |

| Batavia Dana Dinamis | 9271.410 | 0.42% | 2.31% | -1.67% | -1.27% | -1.18% | 15.34% | 827.14% | 3 Jun 2002 | 198.28 B |

| Syailendra Balanced Opportunity Fund | 3289.940 | 0.10% | 4.75% | 5.05% | 6.55% | 3.45% | -5.85% | 228.99% | 22 Apr 2008 | 80.63 B |

Provided by Cermati Invest, last update 9 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Cipta Saham Unggulan Syariah | 2182.420 | 4.36% | 4.71% | -7.04% | -6.79% | -17.85% | 11.90% | 118.24% | 5 Sep 2018 | 17.97 B |

| Cipta Sakura Equity | 1150.670 | 2.30% | 2.64% | -5.66% | -3.26% | -8.06% | 10.15% | 15.07% | 11 Dec 2014 | 26.25 B |

| Cipta Rencana Cerdas | 17132.600 | 1.61% | 2.60% | -4.65% | -3.72% | -8.08% | 21.20% | 1613.26% | 9 Jul 1999 | 78.60 B |

| SAM Indonesian Equity Fund | 2273.810 | 1.49% | -0.60% | -4.17% | -2.11% | 3.64% | 24.83% | 127.38% | 18 Oct 2011 | 1.01 T |

| HPAM Ekuitas Syariah Berkah | 1962.668 | 1.08% | 6.46% | 19.16% | 19.39% | 44.36% | 97.38% | 96.27% | 20 Jan 2020 | 1.69 T |

| HPAM Ultima Ekuitas 1 | 2869.846 | 0.84% | 0.97% | 8.26% | 4.95% | 16.69% | 22.29% | 186.98% | 2 Nov 2009 | 772.29 B |

| Danakita Saham Prioritas | 1179.050 | 0.82% | 3.54% | -2.17% | -0.75% | -0.55% | 36.57% | 17.91% | 17 Oct 2018 | 10.28 B |

| Cipta Saham Unggulan | 2795.810 | 0.78% | 2.03% | -4.24% | -4.60% | -10.56% | 23.82% | 179.58% | 4 Dec 2018 | 45.22 B |

| Batavia Dana Saham | 63305.100 | -0.52% | 2.38% | -2.22% | -1.19% | -1.55% | 15.47% | 6230.51% | 16 Dec 1996 | 1.96 T |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1241.577 | -1.11% | 2.18% | -5.46% | -3.74% | -4.63% | 36.87% | 24.16% | 3 Nov 2020 | 125.95 B |

Provided by Cermati Invest, last update 9 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Eastspring Syariah Fixed Income USD Kelas A | 0.9681 | 1.46% | 2.43% | 1.82% | 1.33% | 5.05% | -3.27% | -3.19% | 8 Mar 2021 | 1.11 M |

| Batavia USD Bond Fund | 1.0435 | 1.16% | 1.57% | 1.07% | 0.38% | 1.92% | - | 4.35% | 18 Oct 2022 | 5.92 M |

| Batavia Global ESG Sharia Equity USD | 1.1182 | -3.74% | -1.89% | -0.75% | 0.18% | 3.32% | 4.14% | 11.82% | 27 Jan 2021 | 16.89 M |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.9533 | -8.51% | -2.51% | 1.39% | 0.23% | 0.84% | -29.73% | -4.67% | 28 Oct 2016 | 3.87 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.5713 | -10.15% | -8.21% | -3.54% | -5.63% | -11.49% | -49.52% | -42.87% | 15 Jun 2020 | 5.37 M |

Provided by Cermati Invest, last update 9 Agustus 2024

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 99.7 | 98.7 | 6.56% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 102.8 | 101.8 | 6.86% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 100 | 99 | 6.75% | BBB |

| INKP01CCN1 | IDA0001069C2 | IDR | 11.00% | 5-Jun-25 | 101.5 | 100.5 | 9.10% | idA+ |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101 | 100 | 9.92% | idA |

Provided by Cermati Invest, last update 9 Agustus 2024

Event Calendar

| Monday, 12 August 2024 | Previous | Consensus | Forecast | ||

| 1:00 PM | DE | Harga Grosir (Bulanan) JUL | -0.30% | -0.001 | |

| 1:00 PM | DE | Harga Grosir (Tahunan) JUL | -0.60% | -0.004 | |

| CN | Pinjaman Baru Yuan JUL | CNY2130B | CNY450B | CNY550.0B | |

| Tuesday, 13 August 2024 | Previous | Consensus | Forecast | ||

| 1:00 AM | US | Laporan Anggaran Bulanan JUL | $-66B | $-59.0B | |

| 1:00 PM | GB | Tingkat Pengangguran JUN | 4.40% | 4.50% | 4.40% |

| 1:00 PM | GB | Penghasilan Rata-rata termasuk. Bonus (3Bulan/Tahun) JUN | 5.70% | 4.50% | |

| 1:00 PM | GB | Perubahan Penyerapan Lapangan Kerja JUN | 19K | -35.0K | |

| 4:00 PM | DE | Indeks Sentimen Ekonomi ZEW AUG | 41.80 | 30.60 | 33.00 |

| 7:30 PM | US | PPI MoM JUL | 0.20% | 0.10% | 0.10% |

| 7:30 PM | US | PPI Inti MoM JUL | 0.40% | 0.20% | |

| Wednesday, 14 August 2024 | Previous | Consensus | Forecast | ||

| 12:15 AM | US | Pidato Bostik Fed | |||

| 3:30 AM | US | Perubahan Stok Minyak Mentah API AUG/09 | 0.18M | ||

| 6:00 AM | KR | Tingkat Pengangguran JUL | 2.80% | 2.80% | |

| 1:00 PM | GB | Tingkat Inflasi YoY JUL | 2.00% | 2.30% | 2.50% |

| 1:00 PM | GB | Tingkat Inflasi Inti YoY JUL | 3.50% | 3.40% | 3.40% |

| 1:00 PM | GB | Tingkat Inflasi MoM JUL | 0.10% | 0.10% | |

| 7:30 PM | US | Tingkat Inflasi Inti MoM JUL | 0.10% | 0.20% | 0.30% |

| 7:30 PM | US | Tingkat Inflasi Inti YoY JUL | 3.30% | 3.20% | 3.30% |

| 7:30 PM | US | Tingkat Inflasi MoM JUL | -0.10% | 0.20% | 0.20% |

| 7:30 PM | US | Tingkat Inflasi YoY JUL | 3.00% | 2.90% | 3.00% |

| 7:30 PM | US | CPI JUL | 314.18 | 314.6 | |

| 7:30 PM | US | IHK dari JUL | 313.049 | 313.2 | |

| 9:30 PM | US | Perubahan Persediaan Minyak Mentah EIA AUG/09 | -3.728M | ||

| 9:30 PM | US | Perubahan Persediaan Bensin EIA AUG/09 | 1.34M | ||

| Thursday, 15 August 2024 | Previous | Consensus | Forecast | ||

| 6:50 AM | JP | Pertumbuhan Ekonomi QoQ Perkiraan Awal Q2 | -0.50% | 0.50% | 0.60% |

| 6:50 AM | JP | Pertumbuhan Gdp Annualized Prel Q2 | -2.00% | 2.10% | 2.30% |

| 8:30 AM | CN | Indeks Harga Rumah YoY JUL | -4.50% | -5.00% | |

| 9:00 AM | CN | Produksi Industrial YoY JUL | 5.30% | 5.20% | 5.00% |

| 9:00 AM | CN | Penjualan Eceran YoY JUL | 2.00% | 2.60% | 3.00% |

| 9:00 AM | CN | Fixed Asset Investment (Ytd) (Tahunan) JUL | 3.90% | 3.90% | 4.00% |

| 9:00 AM | CN | Tingkat Pengangguran JUL | 5.00% | 5.10% | |

| 11:00 AM | ID | Neraca Perdagangan JUL | $2.39B | $1.4B | |

| 1:00 PM | GB | Pertumbuhan Ekonomi QoQ Perkiraan Awal Q2 | 0.70% | 0.60% | 0.70% |

| 1:00 PM | GB | Pertumbuhan Ekonomi YoY Perkiraan Awal Q2 | 0.30% | 0.90% | |

| 1:00 PM | GB | PDB MoM JUN | 0.40% | 0.10% | 0.00% |

| 1:00 PM | GB | Investasi Bisnis QoQ Prel Q2 | 0.50% | 0.70% | -0.40% |

| 1:00 PM | GB | Rata-rata PDB 3-Bulan JUN | 0.90% | 0.60% | |

| 1:00 PM | GB | Neraca Perdagangan Barang JUN | £-17.92B | £-16B | £-17.2B |

| 1:00 PM | GB | Neraca Perdagangan Barang Non-AS JUN | £-6.86B | £-6.05B | |

| 1:00 PM | GB | Produksi Industrial MoM JUN | 0.20% | 0.10% | 0.20% |

| 1:00 PM | GB | Produksi Manufaktur MoM JUN | 0.40% | 0.10% | -0.10% |

| 7:30 PM | US | Penjualan Eceran MoM JUL | 0.00% | 0.30% | 0.20% |

| 7:30 PM | US | Harga Ekspor MoM JUL | -0.50% | -0.10% | |

| 7:30 PM | US | Harga Impor MoM JUL | 0.00% | 0.00% | 0.10% |

| 7:30 PM | US | Klaim Pengangguran Awal AUG/10 | 233K | 232K | 239.0K |

| 7:30 PM | US | Ny-Kekaisaran-Negara-Pabrik-Indeks AUG | -6.60 | -6.00 | -6.00 |

| 7:30 PM | US | Philadelphia-Fed-Pabrik-Indeks AUG | 13.90 | 7.00 | 11.00 |

| 7:30 PM | US | Indeks Harga Eceran di luar Kendaraan Bermotor MoM JUL | 0.40% | 0.10% | 0.20% |

| 8:10 PM | US | Pidato Musalem dari Fed | |||

| 8:15 PM | US | Produksi Industrial MoM JUL | 0.60% | 0.10% | 0.20% |

| 9:00 PM | US | Persediaan Usaha MoM JUN | 0.50% | 0.10% | |

| 9:00 PM | US | Indeks Pasar Properti NAHB AUG | 42.00 | 43.00 | 43.00 |

| Friday, 16 August 2024 | Previous | Consensus | Forecast | ||

| 12:10 AM | US | Pidato Fed Harker | |||

| 3:00 AM | US | aliran Bersih Jangka Panjang TIC JUN | $-54.6B | ||

| 6:00 AM | JP | Reuters - Tankan - Indeks AUG | 11 | 9 | |

| 1:00 PM | GB | Penjualan Eceran MoM JUL | -1.20% | 0.008 | 0.002 |

| 1:00 PM | GB | Indeks Harga Eceran di luar Bahan Bakar Minyak MoM JUL | -1.50% | 0.003 | |

| 1:00 PM | GB | Penjualan Eceran YoY JUL | -0.20% | 0.005 | |

| 7:30 PM | US | Izin Bangunan Sebelumnya JUL | 1.454M | 1.44M | 1.45M |

| 7:30 PM | US | Izin Mendirikan Bangunan (Bulanan) Prel JUL | 3.90% | -0.004 | |

| 7:30 PM | US | Pembangunan Hunian Baru JUL | 1.353M | 1.35M | 1.32M |

| 7:30 PM | US | Housing Starts (Bulanan) JUL | 3% | -0.02 | |

| 9:00 PM | US | Sentimen Konsumen Michigan Perkiraan Awal AUG | 66.4 | 66.7 | 66 |

| Saturday, 17 August 2024 | Previous | Consensus | Forecast | ||

| 12:25 AM | US | Pidato Fed Goolsbee | |||

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT), Marulitua.com

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 5 Agustus 2024

- Cermati Invest Weekly Update 29 Juli 2024

- Cermati Invest Weekly Update 22 Juli 2024

- Cermati Invest Weekly Update 15 Juli 2024