Cermati Invest Weekly Update 26 Agustus 2024

Ulasan Pasar

| INDONESIA | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

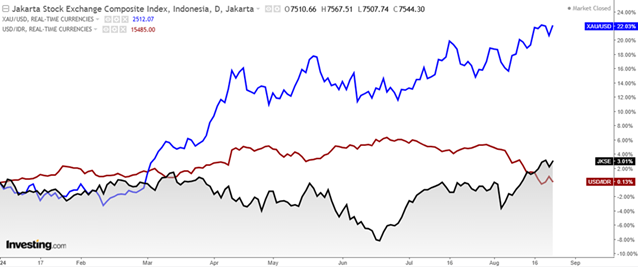

| IHSG | 1.51% | 7,544.30 |

| LQ45 | 1.94% | 943.22 |

| IDX30 | 1.66% | 477.80 |

| FTSE Indonesia | 1.72% | 3,657.57 |

| MSCI Indonesia | 1.44% | 7,461.89 |

| USD/IDR | -1.81% | 15,401.00 |

Provided by Cermati Invest, last update 23 Agustus 2024

IHSG & Saham Pekan Ini

IHSG, pekan lalu mencatatkan angka tertinggi baru di 7594.54, walau demikian IHSG masih meninggalkan support gap di 7366 (1) dan 6968.136 (2). Kuartal III ini, IHSG aman selama di atas 7105.776 ( quarterly pivot).

SAHAM, performa beberapa indeks konstituen berikut ini lebih tinggi dari IHSG, di urutan teratas adalah Pefindo PrimeBank10, Bisnis-27, Sri-Kehati, IDX30.

Sedangkan dari sisi bisnisnya pekan lalu yang terbaik adalah dari sektor Cyclicals, Industri, Transportasi, Energi, dan Keuangan. Di antara lima sektor tersebut yang menjaga IHSG tetap stabil sejak awal Agustus 2024 adalah emiten-emiten dari sektor Keuangan, tetapi sektor yang sejak pertengahan Agustus 2024 menjadi yang tertinggi performanya adalah sektor Cyclicals dengan emiten-emiten terbaiknya antara lain MSIN, MASA, KPIG, FILM.

Pergerakan Rupiah

Sejak 14 Juni 2024 rupiah sudah menguat signifikan 6.97% dari posisi tertinggi Rp16.500 ke Rp15.350 per 1 dolar Amerika pada akhir pekan lalu. Pekan ini rupiah diperkirakan masih menguat di kisaran Rp15.350—Rp15.950. Jika ke depannya rupiah makin menguat, kemungkinan akan mencapai Rp14.750.

| COMMODITY | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| XAU/USD | 0.20% | 2,512.41 |

| Crude Oil WTI | -2.20% | 74.96 |

| Palm Oil c3 F | 5.05% | 3,867 |

| Natural Gas | 2.68% | 2,180.00 |

| Newcastle Coal | -1.60% | 145.20 |

| Nickel | 2.22% | 16,737 |

| Tin | 3.16% | 32,912 |

| Copper | 2.10% | 9,307 |

| Aluminium | 7.46% | 2,542 |

| US Soybeans | 3.65% | 973.00 |

| Silver | 3.39% | 30,256.00 |

Provided by Cermati Invest, last update 23 Agustus 2024

Emas

Pekan lalu emas masih mencatatkan harga tertinggi baru di US$2532 per t.oz. Hampir 1 tahun harga emas dunia up trend dan belum pernah turun sejak keluar dari zona sideways. Harganya bergerak semakin tinggi, bahkan year-to-date 2024 ini sudah naik 22%. Berita dan pidato petinggi The Fed mengenai rencana turunnya suku bunga Amerika selalu mampu membuat harga emas bergerak makin tinggi. Pekan ini emas dunia diperkirakan masih di kisaran harga US$2474—US$2550 per t.oz.

Walau harga emas dunia naik tinggi, tetapi kenaikan harga emas dalam negeri sepertinya tidak terpengaruh, karena rupiah menguat signifikan. Harga emas per gram belum mampu mencetak harga tertinggi baru. Pekan lalu harga emas per gram bahkan turun (-) 1.08% ke posisi penutupan Rp1.250.000, padahal harga emas dunia naik (+) 0.17%. Pekan ini harga emas dalam rupiah akan berada di kisaran Rp1.206.000—Rp1.262.000.

| REGIONAL | ||

|---|---|---|

| Ticker | W (-/+) % | Price |

| Dow Jones | 1.27% | 41,175.08 |

| S&P 500 | 1.45% | 5,634.61 |

| FTSE 100 | 0.20% | 8,327.78 |

| DAX | 1.70% | 18,633.10 |

| Nikkei 225 | 0.94% | 38,419.50 |

| Hang Seng | 1.04% | 17,612.10 |

| Shanghai | -0.87% | 2,854.37 |

| KOSPI | 0.17% | 2,701.69 |

Provided by Cermati Invest, last update 23 Agustus 2024

Reksa Dana & Surat Berharga

Penguatan rupiah yang signifikan, kecenderungan suku bunga yang stabil, dan potensi bahwa IHSG masih up trend, membuat reksa dana pendapatan tetap dan reksa dana saham masih dapat dapat dilirik.

Bingung cari investasi Reksa Dana yang aman dan menguntungkan? Cermati Invest solusinya!

Selain itu pemerintah kembali menawarkan Surat Berharga Negara yaitu Sukuk Ritel SR021 yang terbit 23 Agustus 2024 dan ditawarkan sampai tanggal 18 September 2024 dengan kupon lebih tinggi dari Sukuk Ritel sebelumnya. Ada 2 tenor untuk SR021 ini masing-masing dengan kupon yang cukup menarik, yaitu:

- SR021-T3, tenor 3 tahun, kupon 6.35%

- SR021-T5, tenor 5 tahun, kupon 6.45%

Pembelian investasi Sukuk Ritel seri SR021 hanya bisa dilakukan secara online melalui mitra distribusi resmi yang ditunjuk oleh pemerintah selama masa penawaran berlangsung.

Ketegangan Politik di Indonesia Sempat Memengaruhi Kinerja Pasar Investasi

Pasar investasi kembali bergairah di tengah sedikit meredanya ketegangan politik di dalam negeri pada hari ini. Ketegangan mereda setelah Dewan Perwakilan Rakyat (DPR) RI resmi membatalkan revisi Undang-Undang (UU) Pemilihan Kepala Daerah (Pilkada). Batalnya revisi Undang-Undang tersebut terjadi setelah adanya aksi demo besar-besaran di sekitar gedung DPR RI Kamis kemarin.

Bank Indonesia (BI) melaporkan penyaluran kredit perbankan pada Juli 2024 tetap kuat, tumbuh hingga 11.6% selama satu tahun menjadi Rp7.430,5 triliun. Lajunya lebih tinggi dari bulan lalu yang sebesar 11.4% setahun. Berdasarkan jenis penggunaan, pertumbuhan penyaluran kredit dipengaruhi oleh perkembangan Kredit Modal Kerja, Kredit Investasi, maupun Kredit Konsumsi. Kredit Modal Kerja (KMK) tercatat tumbuh 10.8% dalam setahun pada Juli 2024. Lebih lanjut, kredit investasi tercatat tumbuh 14% pada Juli 2024, naik dari 13.8% pada Juni 2024 dan kredit konsumsi juga meningkat 10.6% pada Juli 2024, dibandingkan 10.2% pada Juni 2024. Kredit konsumsi ini didorong Kredit Pemilikan Rumah (KPR) dan Kredit Kendaraan Bermotor (KKB) serta Kredit Multiguna.

Pergerakan harga emas dunia juga cenderung masih akan menanjak, di tengah kekhawatiran meluasnya pertempuran dari konflik Gaza ke Timur Tengah. Dalam salah satu bentrokan terbesar selama lebih dari 10 bulan perang perbatasan, Hezbollah menembakkan ratusan roket dan drone ke Israel pada hari Minggu, sementara militer Israel mengatakan bahwa mereka menyerang Lebanon dengan sekitar 100 jet untuk menggagalkan serangan yang lebih besar.

Dari sisi Amerika Serikat, investor berfokus pada pernyataan Gubernur Bank Sentral Amerika/The Fed Jerome Powell pada Jumat waktu pekan lalu dalam simposium Kansas City Fed di Jackson Hole, Wyoming. Pidato ini akan menjadi petunjuk baru tentang besarnya penurunan suku bunga yang diharapkan pada September 2024 dan apakah penurunan suku bunga berikutnya mungkin terjadi pada setiap pertemuan setelahnya.

COMPOSITE INDEX compare to USDIDR & GOLD (Daily Performance) since 2024 (YtD)

Reksa Dana

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PASAR UANG | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Insight Money Syariah | 1598.2699 | 0.53% | 1.57% | 2.89% | 3.67% | 5.63% | 15.83% | 59.83% | 30 Sep 2015 | 106.57 B |

| Insight Retail Cash Fund | 1545.7482 | 0.53% | 1.84% | 2.86% | 3.44% | 4.92% | 14.16% | 54.57% | 13 Apr 2018 | 12.33 B |

| BRI Seruni Pasar Uang III | 1723.7515 | 0.50% | 1.41% | 2.66% | 3.39% | 4.99% | 11.77% | 72.38% | 16 Feb 2010 | 1.35 T |

| BRI Seruni Pasar Uang Syariah | 1306.9035 | 0.46% | 1.32% | 2.69% | 3.49% | 5.37% | 12.43% | 30.69% | 19 Jul 2018 | 91.17 B |

| Setiabudi Dana Pasar Uang | 1475.5003 | 0.46% | 1.35% | 2.65% | 3.42% | 5.30% | 13.45% | 47.55% | 23 Dec 2016 | 783.43 B |

| TRIM Kas 2 Kelas A | 1860.7283 | 0.45% | 1.33% | 2.51% | 3.21% | 4.86% | 13.02% | 86.07% | 8 Apr 2008 | 3.38 T |

| Cipta Dana Cash | 1675.48 | 0.44% | 1.35% | 2.67% | 3.48% | 5.42% | 14.34% | 67.55% | 8 Jun 2015 | 216.24 B |

| HPAM Ultima Money Market | 1579.9181 | 0.44% | 1.30% | 2.49% | 3.17% | 4.84% | 13.88% | 57.99% | 10 Jun 2015 | 687.89 B |

| Trimegah Kas Syariah | 1399.4521 | 0.44% | 1.32% | 2.57% | 3.33% | 5.05% | 13.08% | 39.95% | 30 Dec 2016 | 963.07 B |

| Bahana Likuid Syariah Kelas G | 1182.35 | 0.43% | 1.25% | 2.50% | 3.32% | 4.91% | 11.66% | 18.24% | 12 Jul 2016 | 323.32 B |

Provided by Cermati Invest, last update 23 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana PENDAPATAN TETAP | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| HPAM Government Bond | 1594.9058 | 2.68% | 2.62% | 2.49% | 3.06% | 4.98% | 13.99% | 59.49% | 18 May 2016 | 19.38 B |

| BRI Brawijaya Abadi Pendapatan Tetap | 1367.0234 | 2.52% | 2.62% | 2.28% | 2.69% | 4.33% | 13.23% | 36.70% | 25 Feb 2019 | 10.85 B |

| BNI-AM Pendapatan Tetap Quality Long Duration Fund | 1651.78 | 2.30% | 1.78% | 1.47% | 1.81% | 3.52% | 12.84% | 65.18% | 16 Jun 2016 | 12.13 B |

| Principal Total Return Bond Fund | 2611.49 | 2.28% | 2.26% | 2.42% | 2.88% | 2.90% | -2.16% | 161.15% | 21 Aug 2008 | 20.21 B |

| Eastspring IDR Fixed Income Fund Kelas A | 1735.22 | 2.18% | 2.27% | 2.07% | 2.53% | 4.22% | 11.94% | 73.52% | 16 Mar 2015 | 146.30 B |

| Cipta Bond | 1803.13 | 2.16% | 2.24% | 2.42% | 2.93% | 5.03% | 10.19% | 80.31% | 2 Jan 2019 | 25.37 B |

| Syailendra Fixed Income Fund Kelas A | 2580.08 | 2.16% | 2.43% | 1.96% | 2.59% | 4.35% | 12.60% | 158.01% | 8 Dec 2011 | 96.16 B |

| Sequis Bond Optima | 1484.7032 | 1.97% | 2.13% | 2.11% | 2.49% | 4% | 9.17% | 48.47% | 8 Sep 2016 | 39.86 B |

| BRI Melati Pendapatan Utama | 1870.2981 | 1.94% | 2.02% | 1.96% | 2.32% | 4.07% | 10.19% | 87.03% | 27 Sep 2012 | 47.70 B |

| Eastspring Investments IDR High Grade Kelas A | 1667.7 | 1.84% | 1.33% | 1.04% | 1.41% | 3.40% | 9.40% | 66.77% | 9 Jan 2013 | 144.47 B |

| Bahana Mes Syariah Fund Kelas G | 1524.74 | 1.58% | 1.29% | 1.90% | 2.32% | 2.76% | 11.12% | 52.47% | 11 Nov 2016 | 191.88 B |

| BNI-AM Short Duration Bonds Index Kelas R1 | 1061.3 | 1.49% | 1.19% | 0.44% | 1.26% | 1.23% | - | 6.13% | 1 Sep 2022 | 4.92 B |

| Batavia Dana Obligasi Ultima | 2908.3 | 1.10% | 0.74% | -0.07% | 0.06% | 0.27% | -0.75% | 190.83% | 20 Dec 2006 | 1.22 T |

| TRIM Dana Tetap 2 | 3141.77 | 0.91% | 1.90% | 2.94% | 3.64% | 5.09% | 14.66% | 214.18% | 13 May 2008 | 701.64 B |

| Trimegah Fixed Income Plan | 1147.6451 | 0.90% | 0.85% | 0.66% | 1.36% | 0.54% | 5.30% | 14.76% | 23 May 2019 | 2.41 T |

| SAM Sukuk Syariah Sejahtera | 2435.8028 | 0.87% | 0.29% | -0.06% | 0.85% | -0.86% | 0.10% | 143.58% | 29 Oct 1997 | 45.77 B |

| Eastspring Investments Yield Discovery Kelas A | 1604.68 | 0.85% | 1.07% | 0.28% | -0.14% | 0.58% | -2.30% | 60.47% | 29 May 2013 | 78.55 B |

| Insight Haji Syariah | 4907.0277 | 0.58% | 1.76% | 3.28% | 4.18% | 6.14% | 22.14% | 390.70% | 13 Jan 2005 | 1.41 T |

| HPAM Pendapatan Tetap Prima | 1055.2399 | 0.57% | 0.44% | 0.78% | 1.72% | 1.77% | 3.58% | 5.52% | 29 Oct 2018 | 216.09 B |

| Insight Renewable Energy Fund | 2223.4187 | 0.57% | 1.73% | 3.26% | 4.25% | 6.97% | 19.14% | 122.34% | 22 Jun 2011 | 821.21 B |

Provided by Cermati Invest, last update 23 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana CAMPURAN | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| HPAM Flexi Plus | 2043.5981 | 9.44% | 13.29% | 19.76% | 16.78% | 32.94% | 21.56% | 104.36% | 2 Mar 2011 | 57.25 B |

| Setiabudi Dana Campuran | 1486.2199 | 3.95% | 7.09% | 8.22% | 9.79% | 7.52% | 45.94% | 48.62% | 25 Sep 2017 | 66.83 B |

| Danakita Investasi Fleksibel | 1495.56 | 2.29% | 4.56% | 2.25% | 3.78% | 5.71% | 14.44% | 49.56% | 8 Jun 2017 | 10.27 B |

| Sequis Balance Ultima | 1273.2684 | 2.22% | 3.76% | 1.39% | 1.90% | 3.86% | 17.62% | 27.33% | 8 Sep 2016 | 102.97 B |

| Batavia Dana Dinamis | 9463.57 | 1.72% | 4.22% | -0.34% | 0.78% | 0.94% | 15.47% | 846.36% | 3 Jun 2002 | 198.28 B |

| Syailendra Balanced Opportunity Fund | 3358.38 | 1.08% | 5.99% | 4.92% | 8.76% | 5.32% | 0.98% | 235.84% | 22 Apr 2008 | 80.63 B |

Provided by Cermati Invest, last update 23 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana SAHAM | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Cipta Saham Unggulan Syariah | 2283.53 | 8.54% | 10.21% | -2.82% | -2.47% | -14.22% | 14.96% | 128.35% | 5 Sep 2018 | 17.97 B |

| Syailendra MSCI Indonesia Value Index Fund Kelas A | 1129.29 | 4.89% | 6.34% | -6.95% | -4.72% | -5.05% | 25.67% | 12.93% | 8 Jun 2018 | 811.78 B |

| Cipta Rencana Cerdas | 17888.07 | 4.83% | 7.94% | -2.27% | 0.53% | -3.36% | 24.63% | 1688.81% | 9 Jul 1999 | 78.60 B |

| Cipta Saham Unggulan | 2922.87 | 4.76% | 6.38% | -1.75% | -0.26% | -6.13% | 27.48% | 192.29% | 4 Dec 2018 | 45.22 B |

| HPAM Ultima Ekuitas 1 | 2982.0763 | 4.52% | 3.25% | 10.29% | 9.05% | 17.36% | 27.19% | 198.21% | 2 Nov 2009 | 772.29 B |

| UOBAM Indeks Bisnis-27 | 1453.6708 | 4.06% | 8.14% | -1.65% | 0.89% | -0.28% | 33.98% | 45.37% | 15 Aug 2012 | 36.52 B |

| SAM Indonesian Equity Fund | 2365.67 | 3.59% | 3.29% | -2.52% | 1.85% | 6.64% | 27.17% | 136.57% | 18 Oct 2011 | 1.01 T |

| Danakita Saham Prioritas | 1226.02 | 3.48% | 7.25% | 0.66% | 3.21% | 3.36% | 38.21% | 22.60% | 17 Oct 2018 | 10.28 B |

| Insight Sri Kehati Likuid - I Sri Likuid | 1190.7078 | 2.89% | 7.80% | -5.29% | -1.41% | -2.58% | 37.02% | 19.07% | 29 Mar 2018 | 15.32 B |

| Eastspring Investments Alpha Navigator Kelas A | 1615.32 | 2.85% | 7.34% | -0.01% | 4.54% | 1.89% | 19.84% | 61.53% | 29 Aug 2012 | 79.29 B |

| Syailendra Equity Opportunity Fund | 4153.66 | 2.59% | 4.75% | -1.67% | 1.14% | -0.04% | 5.13% | 315.37% | 7 Jun 2007 | 151.62 B |

| BNI-AM Indeks IDX Growth30 Kelas R1 | 1198.59 | 2.48% | 7.70% | -3.51% | 1.13% | 2.62% | - | 19.86% | 27 Jan 2022 | 4.03 B |

| Bahana Primavera 99 Kelas G | 1338.33 | 2.28% | 4.15% | -1.78% | 1.59% | 1.08% | 23.18% | 33.83% | 5 Sep 2014 | 22.99 B |

| Sequis Equity Maxima | 977.9751 | 2.17% | 3.80% | -0.32% | 0.37% | -1.45% | 15.03% | -2.20% | 25 Aug 2016 | 262.56 B |

| HPAM Ekuitas Syariah Berkah | 1976.5255 | 2.09% | 6.04% | 24.56% | 20.24% | 42.32% | 96.81% | 97.65% | 20 Jan 2020 | 1.69 T |

| Principal Total Return Equity Fund Kelas O | 3277.23 | 2.01% | 3.95% | -4.04% | -1.49% | -5.44% | -1.75% | 227.72% | 1 Jul 2005 | 28.83 B |

| Batavia Dana Saham Optimal | 3252 | 1.76% | 5.59% | -0.96% | 0.09% | -0.80% | 15.62% | 225.20% | 19 Oct 2006 | 341.16 B |

| Trimegah FTSE Indonesia Low Volatility Factor Index | 1276.6596 | 1.48% | 4.86% | -4.44% | -1.02% | -1.26% | 35.36% | 27.67% | 3 Nov 2020 | 125.95 B |

| TRIM Kapital Plus | 4341.84 | 1.16% | 1.23% | -2.54% | -1.54% | -1.45% | 18.17% | 334.18% | 18 Apr 2008 | 405.65 B |

| Batavia Dana Saham | 64817.33 | 1.11% | 4.93% | -0.74% | 1.17% | 0.12% | 15.28% | 6381.73% | 16 Dec 1996 | 1.96 T |

Provided by Cermati Invest, last update 23 Agustus 2024

| Inception | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Reksa Dana USD | NAV | 1M | 3M | 6M | YTD | 1Y | 3Y | % | Date | AUM |

| Batavia Global ESG Sharia Equity USD | 1.1761 | 1.37% | 1.73% | 3.70% | 5.37% | 10.59% | 10.26% | 17.61% | 27 Jan 2021 | 16.89 M |

| Batavia USD Bond Fund | 1.0509 | 1.62% | 1.88% | 2.26% | 1.10% | 3.33% | - | 5.09% | 18 Oct 2022 | 5.92 M |

| Eastspring Syariah Equity Islamic Asia Pacific USD Kelas A | 0.9821 | -1.35% | -0.75% | 3.13% | 3.26% | 6.80% | -23.99% | -1.79% | 28 Oct 2016 | 3.87 M |

| Eastspring Syariah Fixed Income USD Kelas A | 0.9772 | 2.09% | 2.79% | 3.41% | 2.28% | 6.18% | -2.37% | -2.28% | 8 Mar 2021 | 1.11 M |

| Eastspring Syariah Greater China Equity USD Kelas A | 0.5928 | -1.66% | -6.09% | -2.05% | -2.08% | -5.47% | -42.04% | -40.72% | 15 Jun 2020 | 5.37 M |

Provided by Cermati Invest, last update 23 Agustus 2024

Surat Utang/Obligasi

| NAMA OBLIGASI | ISIN | MATA UANG | KUPON | TANGGAL JATUH TEMPO | INDIKASI HARGA BELI | INDIKASI HARGA JUAL | INDIKASI YIELD | RATING |

|---|---|---|---|---|---|---|---|---|

| FR0087 | IDG000015207 | IDR | 6.50% | 15-Feb-31 | 100.3 | 99.3 | 6.44% | BBB |

| FR0097 | IDG000020900 | IDR | 7.13% | 15-Jun-43 | 103.6 | 102.6 | 6.78% | BBB |

| PBS005 | IDP000001505 | IDR | 6.75% | 15-Apr-43 | 99.6 | 98.6 | 6.79% | BBB |

| INKP01CCN1 | IDA0001069C2 | IDR | 11.00% | 5-Jun-25 | 101.75 | 100.75 | 8.68% | idA+ |

| LPPI02ACN1 | IDA0001331A0 | IDR | 10.50% | 4-Jul-26 | 101.25 | 100.25 | 9.76% | idA |

Provided by Cermati Invest, last update 23 Agustus 2024

Event Calendar

| Monday, 26 August 2024 | Previous | Consensus | Forecast | ||

| 3:00 PM | DE | Ifo Business Climate AUG | 87.0 | 86.5 | 86.3 |

| 7:30 PM | US | Durable Goods Orders MoM JUL | -6.6% | 4.0% | 3.0% |

| 7:30 PM | US | Durable Goods Orders Ex Transp MoM JUL | 0.5% | 0.0% | 0.1% |

| 9:30 PM | US | Dallas Fed Manufacturing Index AUG | -17.5 | -14.0 | |

| Tuesday, 27 August 2024 | Previous | Consensus | Forecast | ||

| 1:00 PM | DE | GDP Growth Rate QoQ Final Q2 | 0.2% | -0.1% | -0.1% |

| 1:00 PM | DE | GDP Growth Rate YoY Final Q2 | -0.1% | -0.1% | -0.1% |

| 5:00 PM | GB | CBI Distributive Trades AUG | - 43.0 | - 32.0 | - 19.0 |

| 8:00 PM | US | S&P/Case-Shiller Home Price MoM JUN | 1.0% | 1.0% | |

| 8:00 PM | US | S&P/Case-Shiller Home Price YoY JUN | 6.8% | 7.1% | 7.2% |

| 9:00 PM | US | CB Consumer Confidence AUG | 100.3 | 100.1 | 100.0 |

| Wednesday, 28 August 2024 | Previous | Consensus | Forecast | ||

| 3:30 AM | US | API Crude Oil Stock Change AUG/23 | 0.347M | ||

| 12:15 PM | US | Fed Waller Speech | |||

| 1:00 PM | DE | GfK Consumer Confidence SEP | -18.4 | -17.5 | -17.9 |

| 9:30 PM | US | EIA Crude Oil Stocks Change AUG/23 | -4.649M | ||

| 9:30 PM | US | EIA Gasoline Stocks Change AUG/23 | -1.606M | ||

| 11:00 PM | RU | Unemployment Rate JUL | 2.4% | 2.4% | 2.4% |

| Thursday, 29 August 2024 | Previous | Consensus | Forecast | ||

| 5:00 AM | US | Fed Bostic Speech | |||

| 7:00 PM | DE | Inflation Rate YoY Prel AUG | 2.3% | 2.1% | 2.2% |

| 7:00 PM | DE | Inflation Rate MoM Prel AUG | 0.3% | 0.0% | 0.2% |

| 7:30 PM | US | GDP Growth Rate QoQ 2nd Est Q2 | 1.4% | 2.8% | 2.8% |

| 7:30 PM | US | Corporate Profits QoQ Prel Q2 | -2.7% | -1.5% | |

| 7:30 PM | US | GDP Price Index QoQ 2nd Est Q2 | 3.1% | 2.3% | 2.3% |

| 7:30 PM | US | Goods Trade Balance Adv JUL | $-96.8B | $-97.5B | $-95.0B |

| 7:30 PM | US | Initial Jobless Claims AUG/24 | 232K | 234K | 237.0K |

| 7:30 PM | US | Retail Inventories Ex Autos MoM Adv JUL | 0.2% | ||

| 7:30 PM | US | Wholesale Inventories MoM Adv JUL | 0.2% | 0.2% | |

| 9:00 PM | US | Pending Home Sales MoM JUL | 4.8% | 0.2% | 1.5% |

| 9:00 PM | US | Pending Home Sales YoY JUL | -2.6% | -1.0% | |

| Friday, 30 August 2024 | Previous | Consensus | Forecast | ||

| 2:30 AM | US | Fed Bostic Speech | |||

| 6:30 AM | JP | Unemployment Rate JUL | 2.5% | 2.5% | 2.5% |

| 6:50 AM | JP | Industrial Production MoM Prel JUL | -4.2% | 3.3% | 3.0% |

| 6:50 AM | JP | Retail Sales YoY JUL | 3.7% | 2.9% | 0.5% |

| 12:00 PM | JP | Consumer Confidence AUG | 36.7 | 37.1 | 36.9 |

| 12:00 PM | JP | Housing Starts YoY JUL | -6.7% | -1.0% | -6.9% |

| 1:00 PM | DE | Retail Sales MoM MAY | -1.2% | 0.0% | 0.2% |

| 1:00 PM | DE | Retail Sales YoY MAY | -0.6% | 1.1% | |

| 2:55 PM | DE | Unemployed Persons AUG | 2.802M | 2.814M | |

| 2:55 PM | DE | Unemployment Change AUG | 18K | 16K | 12.0K |

| 2:55 PM | DE | Unemployment Rate AUG | 6.0% | 6.0% | 6.0% |

| 3:30 PM | GB | BoE Consumer Credit JUL | £1.162B | £1.1B | |

| 3:30 PM | GB | Mortgage Approvals JUL | 59.98K | 61K | 60.8K |

| 3:30 PM | GB | Mortgage Lending JUL | £2.65B | £2.3B | |

| 7:00 PM | IN | GDP Growth Rate YoY Q2 | 7.8% | 7.1% | |

| 7:30 PM | US | Core PCE Price Index MoM JUL | 0.2% | 0.2% | 0.2% |

| 7:30 PM | US | Personal Income MoM JUL | 0.2% | 0.2% | 0.2% |

| 7:30 PM | US | Personal Spending MoM JUL | 0.3% | 0.5% | 0.2% |

| 7:30 PM | US | PCE Price Index MoM JUL | 0.1% | 0.2% | 0.2% |

| 7:30 PM | US | PCE Price Index YoY JUL | 2.5% | 2.5% | |

| 8:45 PM | US | Chicago PMI AUG | 45.3 | 44.6 | 45.8 |

| 9:00 PM | US | Michigan Consumer Sentiment Final AUG | 66.4 | 67.8 | 67.8 |

| Saturday, 31 August 2024 | Previous | Consensus | Forecast | ||

| 8:30 AM | CN | NBS Manufacturing PMI AUG | 49.4 | 49.2 | 49.3 |

| 8:30 AM | CN | NBS Non Manufacturing PMI AUG | 50.2 | 50.0 | 50.1 |

Source: BI, CNBC Indonesia, Bloomberg, Investing, Trading Economics, KSEI, Cermati, Artha Investa Teknologi (AIT), Marulitua.com

Disclaimer:

Dokumen ini dibuat hanya untuk memberikan informasi. Isi dokumen ini tidak boleh ditafsirkan sebagai suatu bentuk penawaran untuk membeli/menjual/dijadikan dasar dari atau yang dapat dijadikan pedoman sehubungan dengan suatu perjanjian atau komitmen apa pun atau suatu nasehat investasi.

Baca Juga Cermati Invest Weekly Update Sebelumnya:

- Cermati Invest Weekly Update 19 Agustus 2024

- Cermati Invest Weekly Update 12 Agustus 2024

- Cermati Invest Weekly Update 5 Agustus 2024

- Cermati Invest Weekly Update 29 Juli 2024